We have seen many people who have just applied for GST registration while starting a new business and then they don’t file any GST return till they make any sale and because they think that they are not required to file any GST return since they haven’t undertaken any business activity. Well if you are also one of them and haven’t filed your GST return for past 6 months or more then it’s time to file those return with late fee because otherwise your GST registration can get cancelled.

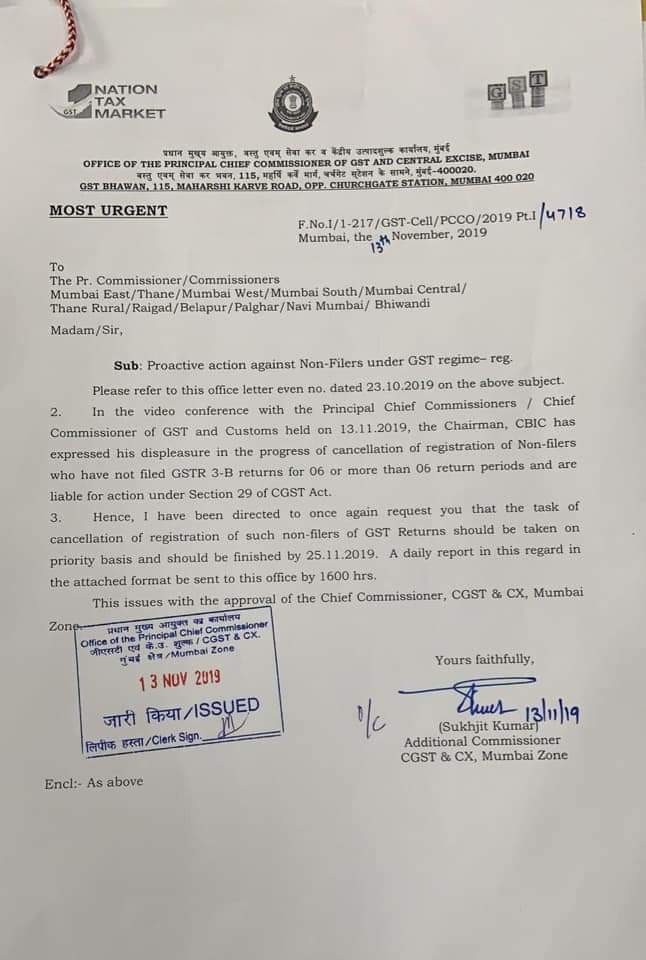

According to a recent internal order being circulated in GST department it is seen that officers have been ordered by their senior to check on taxpayers who have registered with GST but have not filed their GSTR 3B for 6 or more than 6 return period. Those who are found guilty in above situation their registration will get cancelled and GST officers have been order to complete this task before 25.11.2019. So you have very few days to file your return if you haven’t done it till now.

If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)