People were constantly facing issues with GSTR 2A i.e. statement in GST which shows input tax credit (ITC) of a taxpayer, as the same was dynamic and would change as and when supplier would make changes to GSTR 1 (outward supplies return) data.

Hence, people were not sure as to which credit to avail and which not as GST department had restricted the ITC to 10% of the total eligible ITC for which data was not available on portal.

After which people started to take print out of GSTR 2A when they used to file their GSTR 3B return. Thus, it was a requirement for the tax payer to have a static statement which helps them in filing their return and hence GSTR 2B has been launched.

GSTR-2B is an auto-drafted Input Tax Credit (ITC) statement generated for every recipient, on the basis of the information furnished by their suppliers, in their respective Form GSTR-1 & 5 (non resident taxable person) and Form GSTR-6 filed by ISD.

Taxpayers can now reconcile data generated in Form GSTR-2B, with their own records and books of accounts.

Using this reconciliation, they can now file their Form GSTR 3B and they can ensure that no credit is taken twice,

credit is reversed as per law, & tax on reverse charge basis is paid.

Generated Form GSTR-2B consists of:

A summary of ITC available as on the date of its generation and is divided into credit that can be availed and credit that is to be reversed (Table 3)

A summary of ITC not available and is divided into ITC not available and ITC reversal (Table 4).

It is a static statement, generated once on 12th of following month.

The details filed in GSTR-1 & 5 (by supplier) & GSTR-6 (by ISD) would reflect in the next open GSTR-2B of the recipient irrespective of supplier’s/ ISD’s date of filing. For e.g, if a supplier files a document INV-1 dt. 15.07.2020 on 11th August, it will get reflected in GSTR-2B of July (generated on 12th August). If the document is filed on 12th August, 2020 the document will be reflected in GSTR-2B of August (generated on 12th September).

It also contains information on imports of goods from the ICEGATE system including data on imports from Special Economic Zones Units / Developers. (This will be made available shortly)

Reverse charge credit on import of services is not part of this statement and need to be entered by taxpayers in Table 4(A) (2) of FORM GSTR-3B.

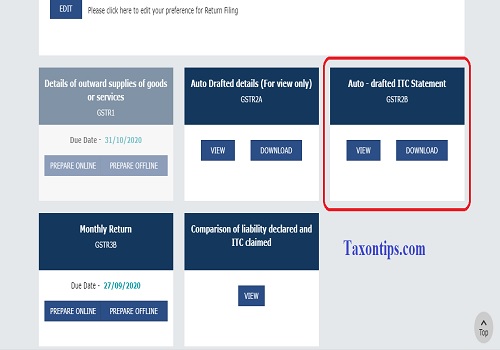

Steps to Download: Taxpayers can access their GSTR-2B through: Login to GST Portal > Returns Dashboard > Select Return period > GSTR-2B.

Important features:

Taxpayers can View or download Summary Statement or Section wise details in excel or PDF format. Taxpayers can view supplier wise summary or document wise details. Email / SMS to taxpayer will be sent informing them about generation of GSTR-2B.

This will be available for the month of July 2020 i.e. from August 12th on trial basis.

Now many people are even confused that whether this will replace GSTR 2A.

The answer is No. Both the statements would simultaneously run where one would be static and another would be dynamic.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)

Comments 2