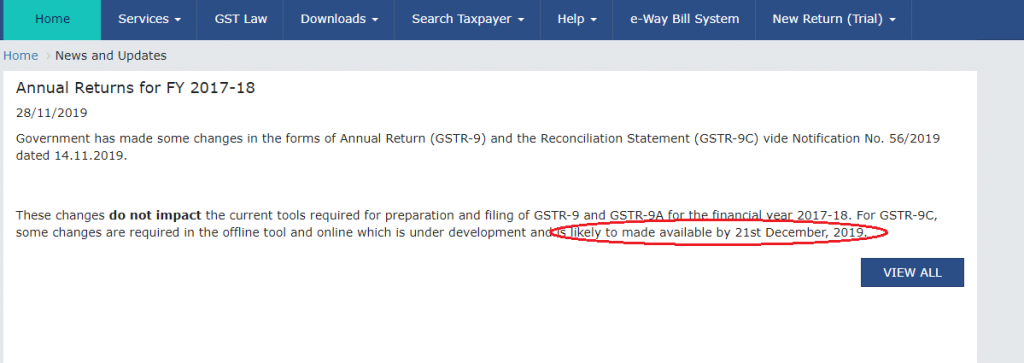

In the 38th meeting of the GST council, it has again recommended to extend the due date for annual return Form 9 and reconciliation statement 9C to 31.01.2020 as the schema for Form 9C would be released on 21.12.2019.

It has been extended till now for atleast five times from the time it has been announced and for the past 1 year the department is still not able to figure out which is the most simplest manner of that Form/ Return.

From past each month it’s just getting extended and which is in turn extending the due date for assessment of such returns.

It would be better if government just make departmental scrutiny of all returns instead of extending such due dates of annual return and in turn would extend it’s assessment due date and due date of next annual return or may be just make the whole thing optional for that year as it was the first year where form was not clear, people were not clear about the form.

If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)

Comments 1