Till now many people would have filed their return of income who were liable to file their return of income and after filing the most important thing which we like to check is whether the return has been processed and have we received refund in our bank account or not.

In this post we will discuss on how you can check if your return has been processed or not and have you received refund or not and if not received then what is the reason.

But before that it’s important to check whether your bank has been pre validated or not because from 31st March 2019 it was announced by CBDT that they will issue all the refunds electronically and therefore pre validating your bank is the basic necessity before checking the refund.

First of all you need to check if your return has been processed or not by Income Tax department and once the return has been processed only then refund is issued and for return to get processed you need to either e verify it or send it to Bangalore by signing the same.

Now let’s see step by step process of how you can check if you have received the refund or not and if you haven’t received then what’s the reason behind that:

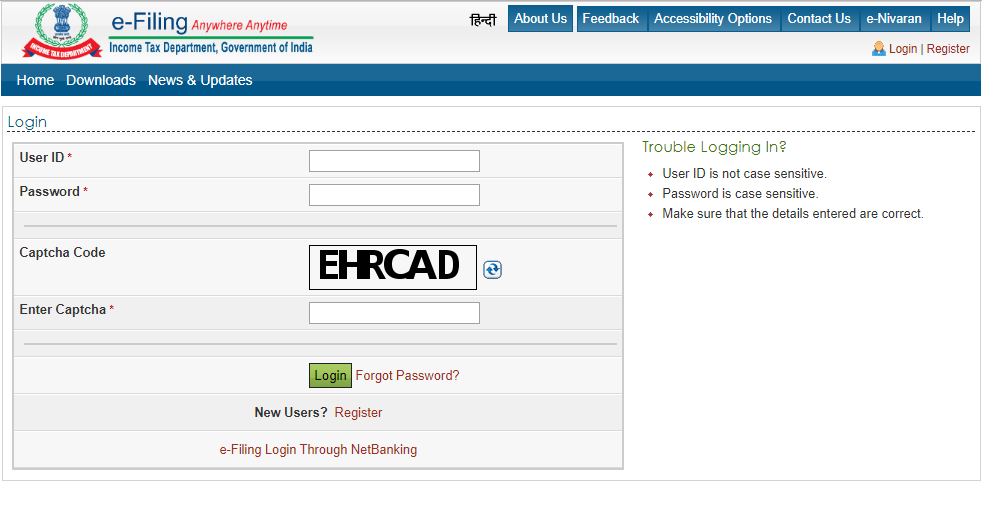

Step 1: Log in to e filing website

Step 2: Then go to My Account -> View e-filed returns/ Forms -> Income Tax return

Step 3: Click on the Acknowledgement number and then you’ll see the status of your Income Tax return. If it’s been processed by Income Tax department then must have received intimation u/s 143(1) on your registered e-mail id and then you can check refund amount in that intimation and later the refund status. However if return has not been processed then you must wait for return to get processed and you will get refund with interest for such extra time it takes to get processed.

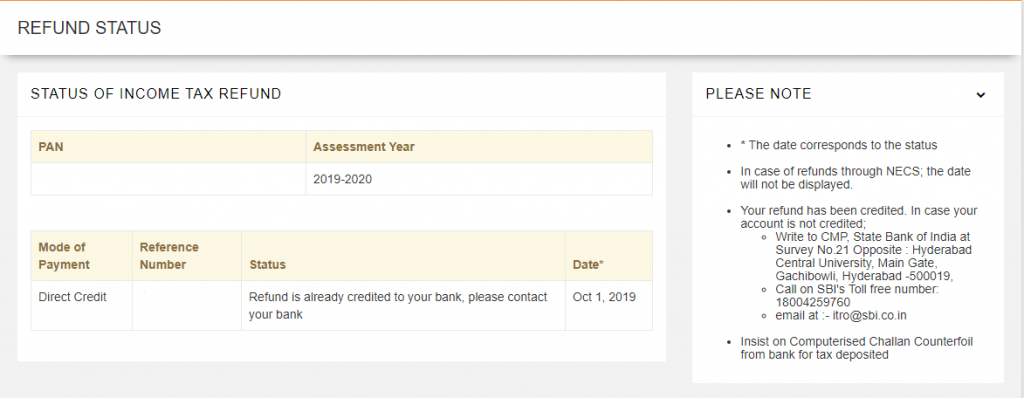

Step 4: If status shows ITR processed then there will be a link to TIN – NSDL website where you can check the status of the refund i.e. on which date it was credited in your bank account and if it’s failed then it will show on e filing website below ITR processed status or even at TIN – NSDL website, you just need to enter PAN number and Assessment year on TIN – NSDL website.

Using this four steps you can easily check the status of your Income Tax refund.

If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)