1. Overview

The Instant e-PAN service is available to all Individual taxpayers, who have not been allotted a Permanent Account Number (PAN) but possess Aadhaar. This is a pre-login service, where you can:

- Obtain digitally signed PAN in electronic format, free of cost, with the help of Aadhaar and your mobile number linked with Aadhaar,

- Update PAN details as per Aadhaar e-KYC,

- Create e-Filing account based on e-KYC details after allotment / updation of PAN, and

- Check status of pending e-PAN request / Download e-PAN either before or after logging in to the e-Filing portal.

2. Prerequisites for availing this service

- Individual who has not been allotted a PAN

- Valid Aadhaar and mobile number linked to Aadhaar

- User not a minor as on date of request; and

- User not covered under the definition of Representative Assessee u/s 160 of the Income Tax Act.

3. Step-by-Step Guide

3.1 Generate New e-PAN

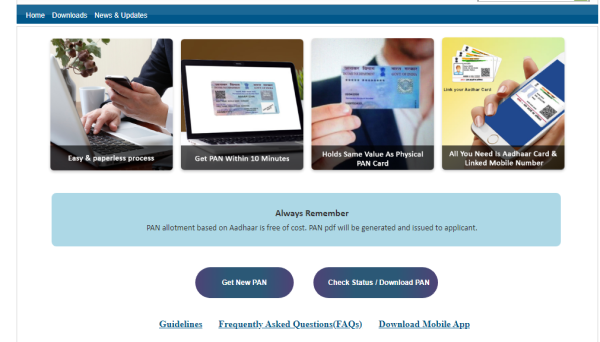

Step 1: Go to the e-Filing portal homepage, click Instant e-PAN.

Step 2: On the e-PAN page, click Get New e-PAN.

Step 3: On the Get New e-PAN page, enter your 12-digit Aadhaar number, select the I confirm that checkbox and click Continue.

Note:

- If the Aadhaar is already linked to a valid PAN, the following message is displayed – Entered Aadhaar Number is already linked with a PAN.

- If the Aadhaar is not linked with any mobile number, the following message is displayed – Entered Aadhaar Number is not linked with any active mobile number.

Step 4: On the OTP validation page, click I have read the consent terms and agree to proceed further. Click Continue.

Step 5: On the OTP validation page, enter the 6-digit OTP received on the mobile number linked with Aadhaar, select the checkbox to validate the Aadhaar details with UIDAI and click Continue.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

Step 6: On the Validate Aadhaar Details page, select the I Accept that checkbox and click Continue.

Note:

- Linking / Validating email ID (registered with your Aadhaar) is optional.

- If you have updated your email ID in Aadhaar but it has not been validated, click Validate Email. On the Validate Email ID page, enter the 6-digit OTP received on your mobile number linked with Aadhaar and click Continue.

- If you have not updated your email ID in Aadhaar, click Link Email ID. On the Validate Email ID page, enter the 6-digit OTP received on your mobile number linked with Aadhaar and click Continue.

On successful submission, a success message is displayed along with an Acknowledgement Number. Please keep a note of the Acknowledgement ID for future reference. You will also receive a confirmation message on your mobile number linked with Aadhaar.

Thus, this is an Aadhar based PAN and no other document is required for applying for such PAN card and you will be able to instantly get PAN card on new e-filing portal. Hence, you can get PAN in just 5 minutes.

As on the date of this post facility for update PAN is not available on new e-filing website.

You can book phone consultation/ assistance online with expert as mentioned below:

To book ITR filing with experts CLICK ME.

To book phone consultation with experts for Income tax CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

To book phone consultation with experts for GST CLICK ME.

To book general phone consultation with expert CLICK ME.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)