As we know ITR for AY 2020-21 or FY 2019-20 were notified by Income Tax department vide notification Dt. 29.05.2020.

Now, on 02.06.2020 same has also been made available for filing on the e-filing website. Therefore, let’s have a look on what are some important amendments in ITR 1 and who are eligible to file the same.

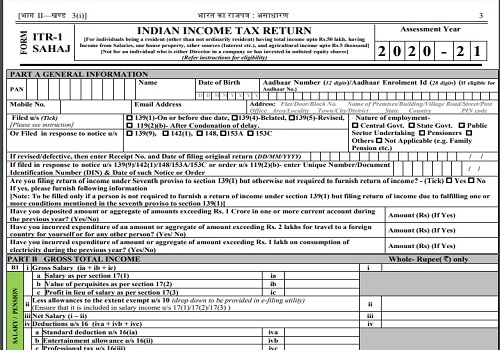

Let’s first see who are eligible to file ITR 1 Form:

1. For individuals being a resident (other than not ordinarily resident) having total income upto Rs.50 lakh.

2. Having Income from Salaries, one house property, other sources (Interest etc.), and agricultural income upto Rs.5 thousand.

3. An assessee who is either Director in a company or has invested in unlisted equity shares cannot use this Form.

4. If an assessee wishes to carry forward Income From House property he cannot do that while filing ITR 1. He/ she will have to use ITR 2.

Below are the major amendments in ITR 1:

1. Compulsory filing of return if these conditions are fulfilled:

Are you filing return of income under Seventh proviso to section 139(1) but otherwise not required to furnish return of income?

If yes, please furnish following information. [Note: To be filled only if a person is not required to furnish a return of income under section 139(1) but filing return of income due to fulfilling one or more conditions mentioned in the seventh proviso to section 139(1)]

Have you deposited amount or aggregate of amounts exceeding Rs. 1 Crore in one or more current account during the previous year? (Yes/No) Amount (Rs) (If Yes).

Have you incurred expenditure of an amount or aggregate of amount exceeding Rs. 2 lakhs for travel to a foreign country for yourself or for any other person? (Yes/ No) Amount (Rs) (If Yes)

Have you incurred expenditure of amount or aggregate of amount exceeding Rs. 1 lakh on consumption of electricity during the previous year? (Yes/No) Amount (Rs) (If Yes)

2. Schedule DI:

As we know due date for investment under 80C to 80U and 54 to 54G was extended to 30.06.2020 and many of us were confused on how it would be shown in ITR and how would they know that amount paid after 01.04.2020 belongs to FY 2019-20 or 2020-21.

Now CBDT has inserted a new schedule, Schedule DI wherein a person need to mention that out of total deduction how much belongs to April, 2020 to June, 2020 period.

Therefore, still it is self declaration and we still dont know how will it be known if a person is taking the same deduction twice and for that we need to wait for next year’s ITR.

This are the two major amendments in ITR 1 other than these everything is the same as previous year.

However it is still suggested to file return after 15th July once everyone files their TDS return till 30th June for last quarter FY 2019-20 and TDS credit is available in Form 26AS.

CLICK HERE to file your Income Tax return, with the help of our experts.

This article is just for information purpose and are personal views of the author. It is always advisable to hire a professional for practical execution or you can mail us. If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)

Comments 2