As we know ITR for FY. 2019-20 were released. Also ITR 1 and ITR 4 are now available for filing at the e-filing website. We have even discussed the various important amendments that has been made to ITR Forms.

However, there are many changes being made to even ITR Acknowledgement or as many of us call it ITR V. It is a 1-page verification document which summarizes your total income, deduction and taxes paid or refund claimed.

Initially all of us used to print ITR V after filing our return of income and then send it to CPC bangalore, then came digital signature and mainly in the case of audit we used to digitally sign/ verify the ITR and we were not required to send it physically.

Now, we have the facility to verify our ITR through Aadhar OTP, Net banking, Demat account or bank account.

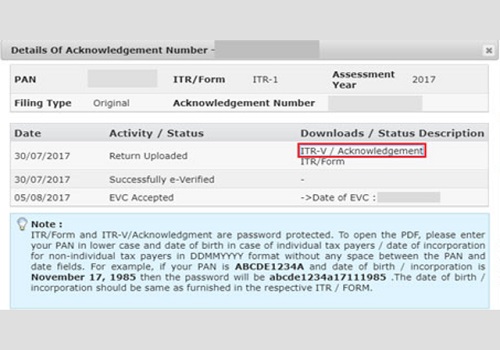

Until last year we could print our ITR V and send it to CPC bangalore within 120 days of filing our return of income. However now from FY 2019-20 you cannot download your ITR V, if you either don’t send it to CPC, bangalore or e-verify the same online within 120 days.

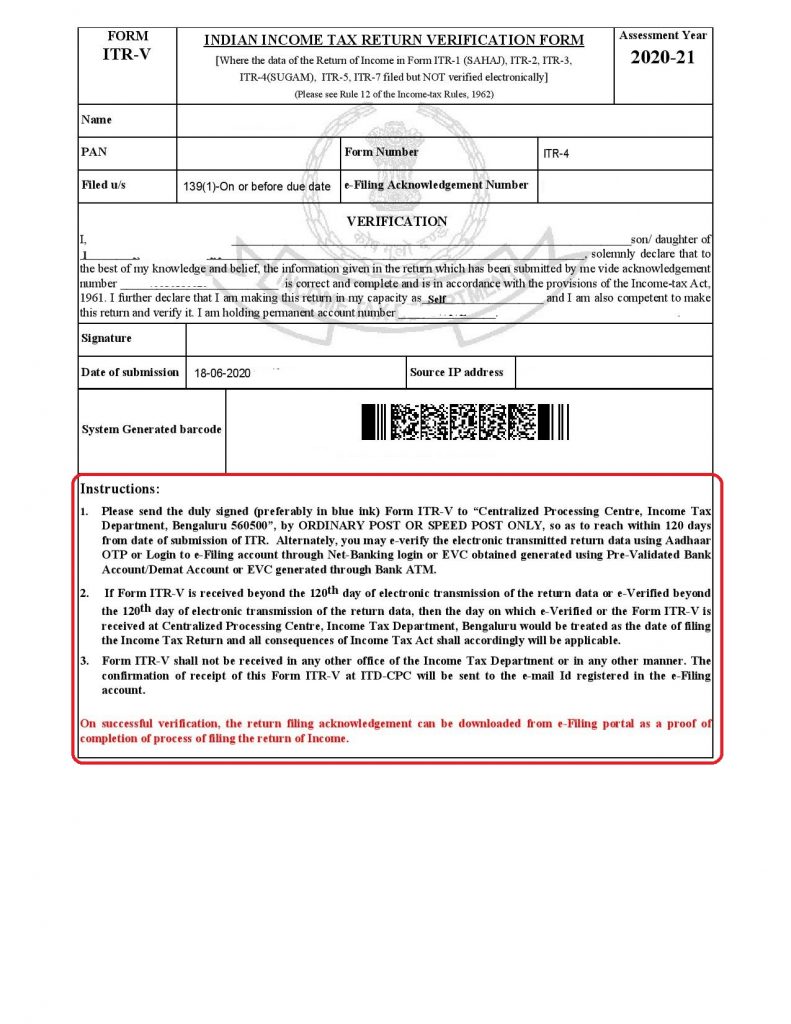

Now when you file your Income tax return and go on to download ITR acknowledgement you will find a verification Form which will look something like this:

As you can see you will only get the verification Form after filing the return of income and you can either send it to CPC physically or e-verify the same.

Also, there are instructions mentioned below as to where you need to send the return.

One interesting thing to note here is that in point no. 2 it has been mentioned that if return is received/ e-verified after 120 days then it would be considered as if the return was filed on that date. Whereas earlier if you send the return after 120 days or e-verify the same after 120 days either you had to submit condonation request or after sometime same would be considered as invalid return.

Hence this could mean that if you file return of income and send it before end of assessment year and after 120 days it would be considered as belated return but not invalid return.

Also in the end it has been mentioned that once you verify the return then you could download the return acknowledgement.

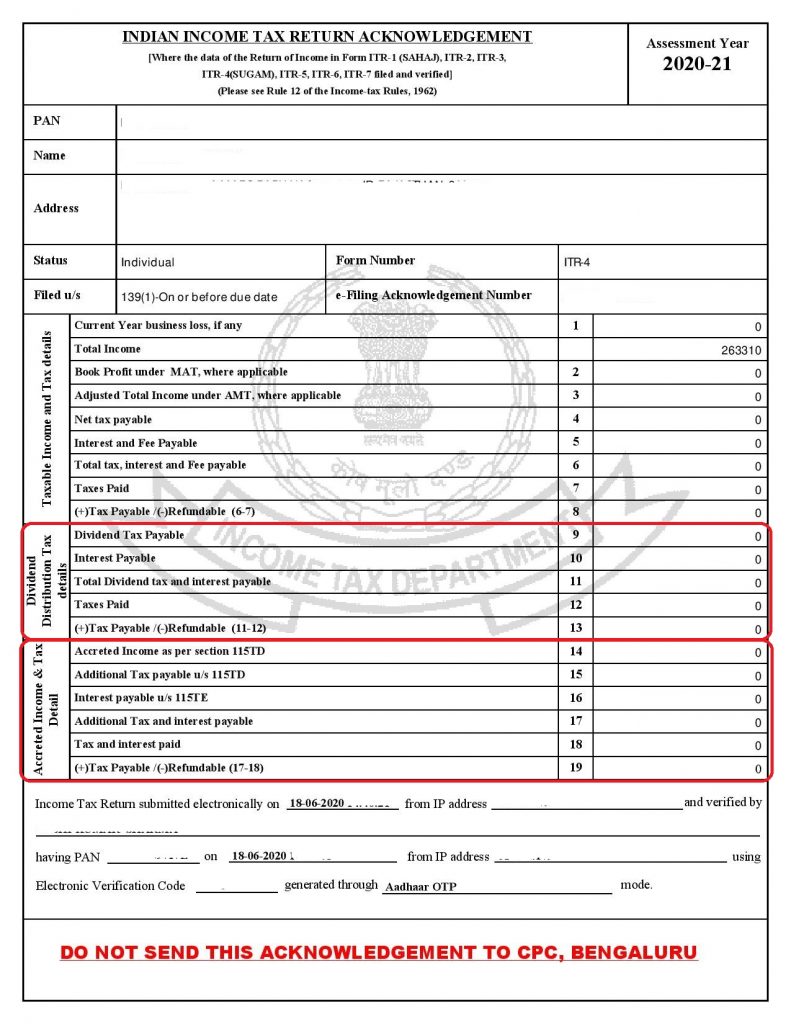

Now, let’s take a look at the changes made to ITR accknowledgement:

On the left hand side is the old ITR V and on the right hand side is the new ITR V.

Various differences in both the ITR V are as follows:

Things removes from old ITR V:

Total deduction under Chapter VI-A.

Bifurcation of taxes paid.

Details of exempt income.

Things added in New Return:

Details of dividend distribution tax. (It is ironic that this is the last year of Dividend distribution tax and now they have added it to ITR V).

Details of Accreted Income and tax on same u/s 115TD and 115TE which again shows the motive of CBDT to keep an eye on Trust as re-registration was announced in Budget, 2020.

Our thoughts:

It would have been great if details of Deduction under Chapter VI-A and exempt income would not have been removed.

Thus, this will now stop the people from filing return of income on e-filing website just for loan/ or other verification purpose and submitting ITR V to bank without verifying the same on e-filing website so that same is not processed by Income tax department.

Comments 3