After the announcement was made on 08.04.2020 relating to release of refund in Income Tax upto Rs. 5 lakh many people were curious on when will they receive the refund.

Now we are seeing that plan in action Income tax department is sending e-mail and messages to people who are claiming refund to confirm on their e-filing portal that refund claimed by them is genuine and they haven’t filed any revise return after that return in which refund amount has been changed. The E-mail received is as under:

“Dear Taxpayer,

It is seen that a claim of refund has been made in the Income Tax Return xxxxxxxxxxx for 2019 filed by you on xx-JUN-2019.

Your Income Tax Return has been selected under risk management process wherein your confirmation is required on the claim of refund. You are requested to submit your response in the e-Filing Portal post login by selecting either of the following options:

- The claim of refund is correct to the best of my knowledge and belief

- Return of Income is being revised wherein, correct claim of refund shall be made

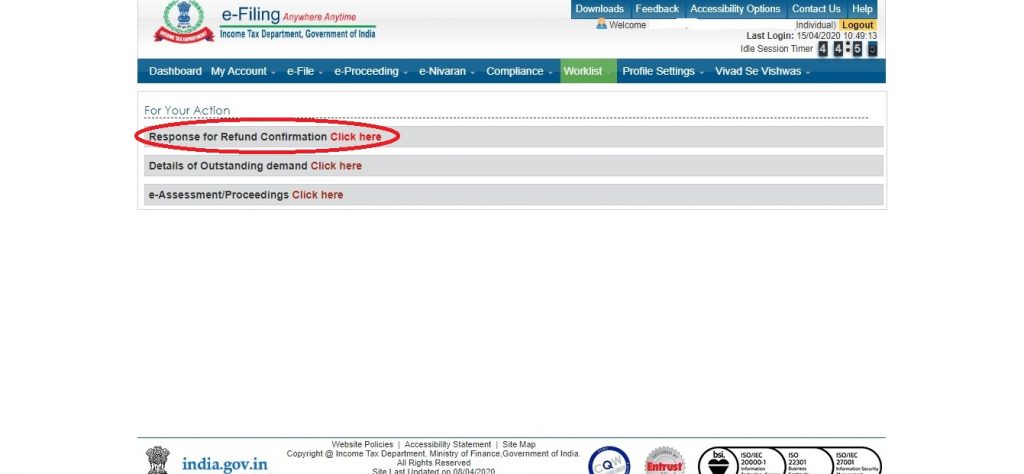

To submit the above mentioned response, please login to e-Filing portal, Go to Worklist->For Your Action-> Response for Refund Confirmation.

Please verify the claims made in your Return of Income filed and submit your response accordingly. In case of any incorrect claims, please revise your Income Tax Return (ITR) .

Please submit your response within 30 days of receipt of this e-mail.

Please ignore this mail, if you have already submitted your response.

Regards,

Compliance Management Team

Income Tax Department”

The people are also receiving messages on their registered mobile number in the same fashion:

“Refund claimed in ITR for AXXXXX021R for AY 2019 needs re-confirmation by you. Please check email for details and submit response in www.incometaxindiaefiling.gov.in“

This are just re confirmation mail/ messages by Income tax department as they cannot process all the returns they are refunding the amount on provisional basis based on self declaration and based on the return they have processed as would be mentioned in the e-mail.

You need to just log in to the Income tax website->go to for your action. There you will find below option: Response to refund confirmation.

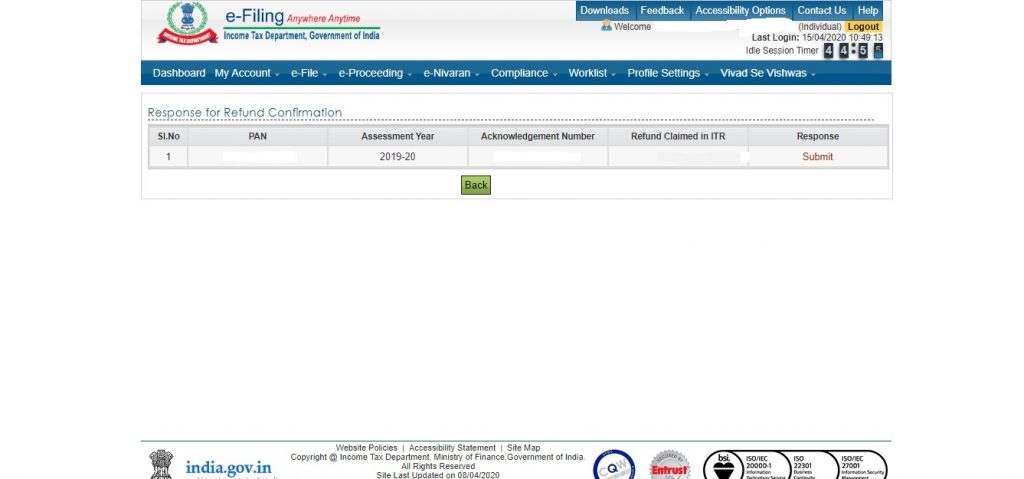

Next they will show you the year for which refund is pending and you need to send confirmation for same. Press submit.

In the last step just confirm if you have revised any return after filing of the return which is being processed for refund or are you going to revise the return in future as this is kind of self declaration because the date for revise return has also been extended. Hence if you have filed revised return choose the second option or else choose the first option.

Within few days you will receive refund in your pre-validated bank account.

This has nothing to do with any suspect on you or your refund or many people are even thinking that their case will be selected in scrutiny because of this. It’s nothing like that those whose refund is pending all are receiving this so that refund can be processed properly and all genuine cases can receive proper refund during this times.

This article is just for information purpose it is always advisable to hire a professional for practical execution. If you need assistance you can ask a question to our expert and get the answer within an hour or post a comment about your views on the post and also subscribe to our newsletter for latest weekly updates.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-350x250.webp)

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)

I have received notice under risk management. I have selected option1 and submitted. Will the govt ask any proof and if i get selected for srutiny , can i revise the return after receiving scrutiny notice.

Pl. confirm. Thankyou

Dear mounika,

You can read our latest article on the same for more info: https://www.taxontips.com/submit-response-to-confirm-revise-the-refund-claim-why-are-you-getting-this-mail-and-how-to-get-refund/

Regards,

Team Taxontips.com

I have received notice under risk management. I have selected option1 and submitted. Will the govt ask any proof and if i get selected for srutiny , can i revise the return after receiving scrutiny notice.

i have selected Second option of revised return by mistake.

what can i do next to get refund ?

Can you please elaborate on your query as to which option you have selected or you can book a phone consultation with our expert for a better understanding.

To book consultation CLICK HERE: https://www.taxontips.com/tax-notice-personal-consultation/

Regards,

Team Taxontips.com

I have received the mail by ITR department as subject “Response to confirm/Revise claim of refund for AY 2022-23” I want to response them but no pending notice is showing in worklist options on ITR portal. In this case, how can i response that mail.

Dear Nilesh,

You can read our latest article on the same for more info: https://www.taxontips.com/submit-response-to-confirm-revise-the-refund-claim-why-are-you-getting-this-mail-and-how-to-get-refund/

Regards,

Team Taxontips.com

I have also got same notice. My refund is reduced by applying penalty of Rs 10,000 for late return filing. Whereas i have filed return on 09 Jan, 2021 well before last day of filing the return. If i accept refund then i will receive lower refund amount. What shall i do ? Please help.

We need to check the same and only then we can comment.

We would request you to book a consultation with our expert and submit your notice.

You can book a consultation at:https://www.taxontips.com/tax-notice-personal-consultation/

Regards,

Team Taxontips.com

I have received the same notice as well, not sure why ? any help ?

This is not a notice just a reconfirmation for refund.

If you need any further assistance you can book consultation with our experts at: https://www.taxontips.com/tax-notice-personal-consultation/

Regards,

Team Taxontips.com

After submitting this , how many days again it will take to process

Sorry but there is no such timeline defined by government.

Regards,

Team Taxontips.com

I have received the mail or risk management process mentioned in article. Will my return be selected for scrutiny ?

Not really,

Regards,

Team Taxontips.com