GST news

Reduction and Rationalization of GST late fees based on turnover announced in 43rd GST council meeting

The amnesty scheme announced above was retrospective in nature and was applicable for returns upto April 2021 and along with...

Read moreSelf certification of GSTR 9C instead CA certified | Simplification of GST annual return GSTR 9

furnishing reconciliation statement in FORM GSTR-9C, as taxpayers would be able to self-certify the reconciliation statement, instead of getting it...

Read moreDetails of announcement made in 43rd GST council meeting held on 28.05.2021 [Updated with press release]

GST council meeting i.e. 43rd GST council meeting has been held and the key highlights of the meeting are as...

Read moreGST amnesty scheme announced in 43rd GST council meeting for non filers | Sources

According to sources the scheme shall provide a concession in late fees as under: Rs. 500 per GSTR 3B return...

Read moreNew rules for revocation of cancellation of registration, refund and various other Forms notified by CBIC under GST

CBIC has vide notification no. 15/2021 Dt. 18.05.2021 made changes to various rules of CGST and added a few rules...

Read moreSOP for implementation of the provision of extension of time limit to apply for revocation of cancellation of registration under GST

Standard Operating Procedure (SOP) for implementation of the provision of extension of time limit to apply for revocation of cancellation...

Read moreDate for 43rd GST council meeting has been announced | What to expect ?

The major agenda of this meeting is expected to be short term lending by central government to state government as...

Read moreExtension of the due date for filing Revocation application for cancellation of GST registration

"In view of Notification No. 14/2021 dt. 01.05.2021, the timeline for filing the ‘Application for Revocation of Cancellation’ has been...

Read moreThings to keep in mind for fast and easy customs clearance of COVID related equipment’s or medicaments through courier

Thus, CBIC has issued a directive stating various things, documents and steps to keep in mind and which should be...

Read moreGST relaxation amid the ongoing Pandemic: Late fees, interest, extension of due date etc. [Notification 8/2021 to 13/2021]

Notification 09/2021: This notification is an amendment to notification 57/2020 wherein late fees for GSTR 3B has been waived. It...

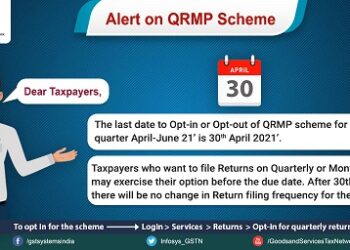

Read moreLast date to apply for QRMP scheme for Quarter April 2021 to June 2021

Many people are still not satisfied with the QRMP scheme as still they have to do all the working to...

Read moreGST website Update: Now file company’s GST return using EVC [Exclusive] and show return frequency on dashboard

Looking at the pandemic although the facility has been brought late but now companies can also file their GST return...

Read moreAdvisory for Implementation of PMT-03 to re-credit the ITC sanctioned as refund

The PMT-03 functionality available at present in the online refund module is only for re-crediting of the rejected amount that...

Read moreGovernment exempts custom duty on import of oxygen and related items

In the current scenario of increasing number of patients the factories of India are not having full capacity to manufacture...

Read moreThings to keep in mind while using pre-filled GST returns | GSTR 3B, GSTR 2B

When GSTR 3B auto imports data from GSTR 2B it imports all the credit and does not look at it...

Read more

![Details of announcement made in 43rd GST council meeting held on 28.05.2021 [Updated with press release]](https://www.taxontips.com/wp-content/uploads/2021/05/GST-council-meeting-updates-350x250.jpg)