As we know new E-filing portal was made live in late evening of 07.06.2021, also known as E-filing 2.0, wherein the whole website have been revamped right from the menu’s, functions etc and people are getting all confused as to how they can perform various functions on the new portal.

We have been trying to discuss and make our readers aware about how they can perform various functions on the new portal wherein we have already discussed:

1. How to register Digital signature on new e-filing portal: https://www.taxontips.com/how-to-register-digital-signature-dsc-on-new-e-filing-website-with-income-tax-department-e-filing-website-2-0/ (People have been reporting that this functionality has been temporarily removed.

2. How to download Form 26AS: https://www.taxontips.com/how-to-download-form-26as-on-the-new-e-filing-website-i-e-e-filing-2-0-step-by-step-guide/

Now in this post we shall discuss the procedure laid down in the new e-filing portal for filing of Part C of Form 15CA and Form 15CB which is used while making payment outside India.

Let’s first understand who needs to file which part of Form 15CA and when do we need to file Part C of Form 15CA:

Part A – If remittance or the aggregate of such remittances is chargeable to tax and does not exceed 5 lakh rupees during the financial year

Part B – If remittance is chargeable to tax and the remittance or the aggregate of such remittances, exceeds 5 lakh rupees during the financial year and an order / certificate u/s 195(2) / 195(3) / 197 has been obtained from the AO

Part C – If remittance is chargeable to tax and the remittance or the aggregate of such remittances, exceeds 5 lakh rupees during the financial year and a certificate in Form No. 15CB from an accountant has been obtained

Part D – If remittance is not chargeable to tax

Thus, Part C needs to be filed if the aggregate amount of remittance during the financial year exceeds Rs. 5 lakh and the same is taxable as per Income Tax act.

For filing Part C of Form 15CA one needs to first get a certificate in Form 15CB from the Chartered Accountant.

Till now the procedure for same was as under:

1. Assessee used to add CA from whom he wishes to get his certificate in Form 15CB.

2. Once the CA has been added, the CA could submit Form 15CB and once he submit the Form online he shall send the acknowledgement number of the Form to the assessee.

3. Then assessee needs to submit Form 15CA from his e-filing account using the acknowledgement number wherein majority details will be fetched and assessee needs to just submit Form 15CA and filing will be complete.

Now with the new e-filing portal the procedure has been completely changed which is as under:

First of all there will be two methods to submit this form:

a) Online mode (i.e. directly on portal)

b) Offline mode (i.e. through offline utility)

In today’s post we shall discuss the online mode as the offline utility is still not available (same shall be available under download section):

Below are the steps to file Form 15CA in online mode:

Step 1: Log-in to e filing website. Under e-file -> Income tax forms you will find an option to submit Form 15CA. There you need to select the AY for which you wish to file and then proceed.

Step 2: Choose Part C of the form.

Step 3: In case, you haven’t added a CA, select a CA to assign the form. Refer to the My CA user manual to learn more.

Step 4: Click Yes to submit the Form to CA after filling the relevant details.

When you have successfully assigned the form, a success message will be displayed with a Transaction ID. An email confirming successful assigning of your form is sent to your and the CAs email registered and a message on your registered mobile number with the e-Filing portal.

Step 5: Once the CA has submitted Form 15CB, you can either Accept or Reject Form 15CA and click Submit.

Note:

- In case you reject the form, you will have to provide a reason in the textbox.

- In case you accept the form, you will be required to enter the remaining details.

Step 6: After accepting the form, you will be taken to the e-Verify page. You can verify the Form using DSC or EVC.

Now that we know the flow of Filing of Form 15CA and 15CB wherein assessee needs to first assign 15CB to a CA and then when the CA submits his form, assessee can accept or reject and submit the form.

So now let’s have a look at the various things we need to keep in mind while filing Form 15CB in online mode:

Let’s first understand the sections of Form 15CB which is as under:

Form 15CB has four sections to be filled before submitting the form. These are:

- Remittee (Recipient) Details

- Remittance (Fund Transfer) Details

- Chartered Accountant Details

- Attachments

Remittee (Recipient) Details:

The Remittee (Recipient) Details page where details / profile of the recipient is updated and displayed.

Remittance (Fund Transfer) Details:

The Remittance (Fund Transfer) Details page in which the remittance amount and the bank details are updated and displayed.

Chartered Accountant Details:

The Chartered Accountant Details page is where you provide details of Accountant Name, Firm, Membership ID and Address.

Attachments

This section consists of the required attachments to e submitted by the CA.

Now let’s see the procedure for online submission of Form 15CB:

Step 1: Log in to the e-Filing portal with valid CA credentials.

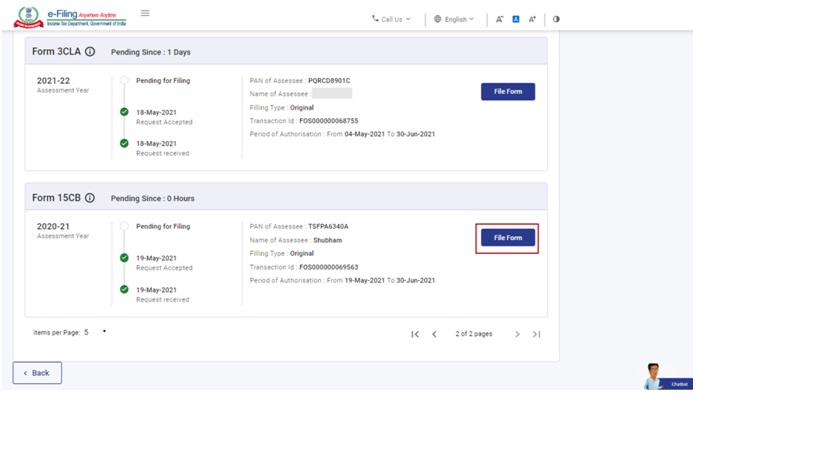

Step 2: On your Dashboard, click Pending Actions -> Worklist.

Step 3: Click Accept against Form 15CB under the For Your Actions tab.

A success message is displayed after your acceptance.

Step 4: On your Worklist, click File Form against Form 15CB.

Step 5: Choose submission mode as Online and click Continue.

Step 6: On the Instructions page, click Let’s get Started.

Step 7: Fill the required details and click Preview.

Step 8: On the Preview page, click Proceed to e-Verify.

Step 9: Click Yes to submit.

Step 10: On clicking Yes, you will be taken to the e-Verify page. e-Verify the form using DSC.

Thus, above is the full procedure to file Form 15CB and Part C of Form 15CA in online mode on new e-filing portal. Do remember that as of now the offline utility for Form 15CB and 15CA is not available and hence we need to wait for same to understand which method will be more feasible.

Also, the user manual for offline utility does not always open on the new website, hence we need to wait for few more days for same and this is causing a huge loss to many people who want to remit the money outside India but are unable to do so as the website is not working and this is causing them to pay interest on same and causing financial loss.

Do you think Income tax department should have kept the old website also live for sometime till the new website becomes stable as it causing a huge loss to many people. Comment your thoughts below.

Disclaimer: The views presented in the above article are personal views of our team and has no legal binding. For any legal opinion consult a tax professional.

To book phone consultation with experts CLICK ME.

To book ITR filing with experts CLICK ME.

To book consultation for Faceless Assessment with experts CLICK ME.

![[Live] Updates and Tax changes for Budget 2023 | Tax on cryptocurrency | Income tax and GST udpates in Budget 2023 [Download Bill]](https://www.taxontips.com/wp-content/uploads/2023/02/Budget-2023-120x86.webp)

Every where “Attachments” to 15CB is envisaged. WHAT attachment is expected here? Please advise urgently.

Thanks and regards

Sivaraman Viswanathan

The Attachments field is not mandatory but you could attach Invoice, agreement, PAN card details, TRC etc based on which the Chartered Accountant can derive the taxability of that transaction.

Disclaimer: The views presented in the above article are personal views of our team and has no legal binding. For any legal opinion consult a tax professional.

Regards,

Team http://www.Taxontips.com